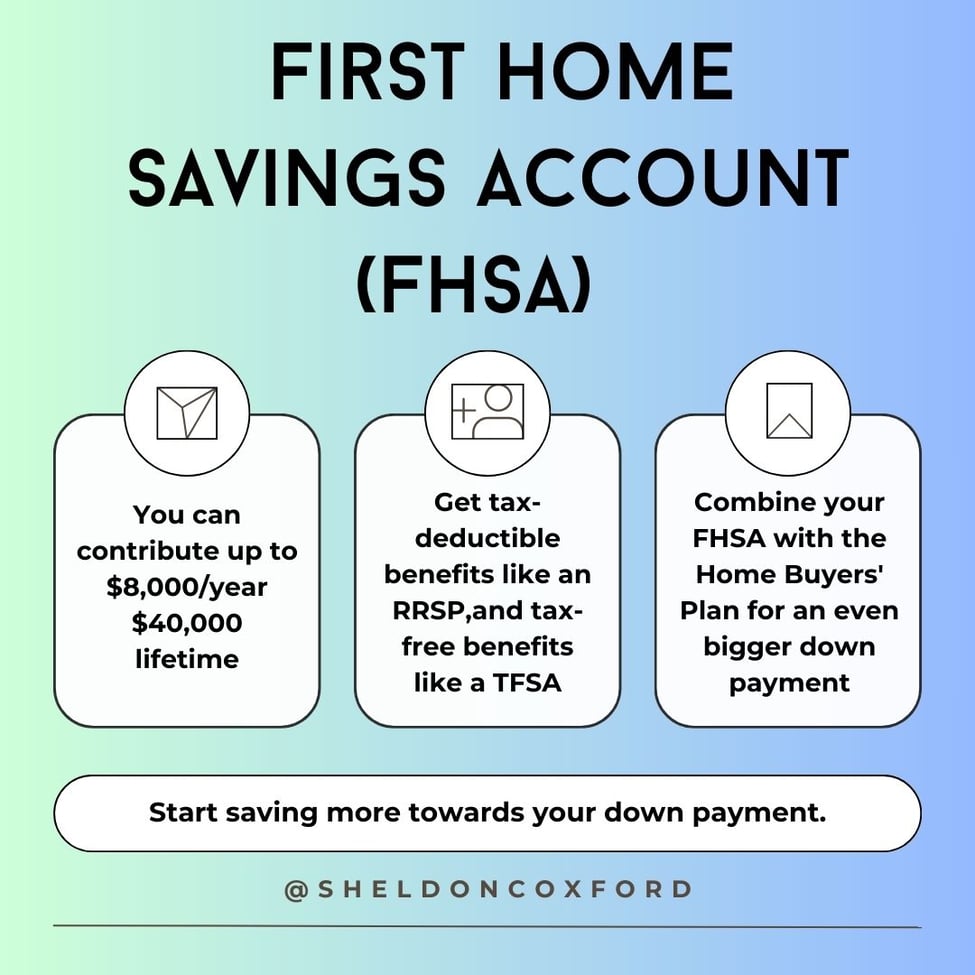

The First Home Savings Account (FHSA) is a powerful new tool designed to help Canadians save for their first home. This account offers a unique combination of benefits from both the RRSP and TFSA, allowing individuals to contribute up to $8,000 annually with a lifetime limit of $40,000. Contributions are tax-deductible, and both investment growth and qualifying withdrawals are tax-free, making it an attractive option for first-time homebuyers. With the flexibility to invest in various financial products and the ability to work alongside the Home Buyers' Plan, the FHSA simplifies the path to homeownership by providing significant tax advantages and a straightforward saving mechanism.

Overview

- Purpose: The FHSA is designed to assist Canadians in saving for the purchase of their first home. It combines features of both a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA).

- Eligibility: Canadians who are 18 years or older and have not owned a home in the current year or any of the previous four years can open an FHSA.

Contributions

- Contribution Limits: Individuals can contribute up to $8,000 per year, with a lifetime contribution limit of $40,000.

- Carry-Forward: Unused contribution room can be carried forward, but the maximum annual contribution cap of $8,000 still applies.

Tax Benefits

- Tax Deductible Contributions: Contributions to an FHSA are tax-deductible, similar to RRSP contributions. This means that contributions can reduce an individual's taxable income.

- Tax-Free Growth: Investment growth within the FHSA is tax-free, similar to a TFSA.

- Tax-Free Withdrawals: Withdrawals from the FHSA for the purpose of purchasing a first home are tax-free, provided the funds are used to buy a qualifying home within 15 years of opening the account.

Withdrawals

- Qualifying Withdrawals: Funds withdrawn for purchasing a first home are tax-free. The home must be a principal residence, and the withdrawal must be used within 30 days of buying the home.

- Non-Qualifying Withdrawals: If funds are withdrawn for purposes other than purchasing a first home, they will be taxed as income.

Account Duration

- Maximum Duration: An FHSA can remain open for a maximum of 15 years or until the individual turns 71, whichever comes first. If the funds are not used to purchase a home within this period, they can be transferred to an RRSP or a Registered Retirement Income Fund (RRIF) without affecting the contribution room of those accounts.

Coordination with Other Programs

- Home Buyers' Plan (HBP): The FHSA can be used in conjunction with the Home Buyers' Plan (HBP), which allows first-time homebuyers to withdraw up to $35,000 from their RRSP to buy or build a home.

Investment Options

- Variety of Investments: The FHSA can hold a wide range of investments, including mutual funds, stocks, bonds, and GICs, providing flexibility in how the savings are managed.

The FHSA is a strategic tool for Canadians aiming to purchase their first home, offering substantial tax benefits and aiding in the accumulation of a down payment.

Ready to take the first step towards owning your dream home? Connect with expert Vancouver Realtor Sheldon Coxford today! Sheldon’s extensive experience and local market knowledge make him the perfect guide to navigating the homebuying process. Visit sheldonhomes.ca to learn more and start your journey to homeownership with confidence or connect with Sheldon at 778-835-5621 or [email protected]